You are visiting Liisbeth’s archives!

Peruse this site for a history of profiles and insightful analysis on feminist entrepreneurship.

And, be sure to sign up for rabble.ca’s newsletter where Liisbeth shares the latest news in feminist spaces.

A year ago, the Canadian federal government and the Business Development Bank of Canada (BDC) set out to level the playing field for women in tech by increasing the amount set aside for its Women in Technology (WIT) Venture Fund from approximately $100M to $200 million in 2018.

In Canada, studies show only 4 to 7% of all venture capital goes to women majority–owned or women-led tech startups. In the US, the situation is even worse according to a 2018 Tech Crunch study that found only 2.2% of venture capital investment in tech firms went to US-based female-founded startups, a decline from previous years.

Not surprisingly, many placed high hopes on the increased investment in the WIT venture fund to fuel change. Announcement of the fund’s increase came in 2018, in what the government touted as Canada’s first-ever feminist budget, which included a $2 billion investment in women entrepreneurs over the next five years.

A Year Later, What’s Changed?

In an announcement released this April, BDC reported that $17 million (8.5% of the $200 million) has been invested in a total of 25 companies. More than 1000 enterprises inquired about the fund or were encouraged by one of BDC’s 34+ fund managers to consider applying.

One recipient was Innerspace, a company that says it is closing in on an “important problem,” that is helping Google track you once you are inside of a building. At present, you disappear from “under his eye” once you go indoors. According to Innerspace, companies can benefit by keeping their employees under surveillance, minute by minute, to identify efficient use of space. The government clearly agrees and invested $3.5 million in the company, even though its founders are all male. No, wait, on closer surveillance, LiisBeth discovered that Innerspace employs a woman as their chief marketing officer!

When news of the investment came out, sources familiar with the firm quickly expressed outrage on social media. How could BDC use the WIT fund to invest in yet another all-male-founded shop? Is the fund a sham? Does adding one woman to their leadership team truly qualify Innerspace as the type of company politicians had in mind when they created this fund?

More importantly, has the WIT fund changed anything?

In mid-April, The Logic, a snappy new $300/year subscriber only indie news source reported that, despite years of efforts to advance women in tech, 90 percent of Canadian investment deals still go to companies founded exclusively by men. The Logic also wrote that BDC made 47 investments in women-led tech firms from 2014-2018 under the WIT initiative. Those investments represent only 15.8 percent of its total venture portfolio, which translates little change. Or progress that is measured in inches, not yards.

Turns out, social change is hard to scale.

Look! There’s a Woman!

Talks with several BDC officials confirmed that the WIT venture fund eligibility criteria require that companies have at least one woman in an executive leadership role. Shawn Salewski, director of external communications at BDC, says a leadership role in the context of this fund means “an executive on the leadership team driving the direction of the business.” Salewski adds that the fund also considers the length of service of that female exec. “You can’t come in with no women on the team one day and a woman on the next and expect us to invest,” he said. “We won’t. They need to be in the role for at least a year.”

Research shows that half of all tech startups do not have a female executive at all, and only five percent have a female CEO. So, on the surface, a “one-is-better-than-none” rule seems like a good point of intervention. We can be persuaded that limiting access to the WIT fund to firms that are 51 per cent majority owned by women may be impractical in the venture space where founders, of any gender, typically sell more than 50 per cent of ownership in their company in exchange for venture capital raised.

But Where Did the Money Go?

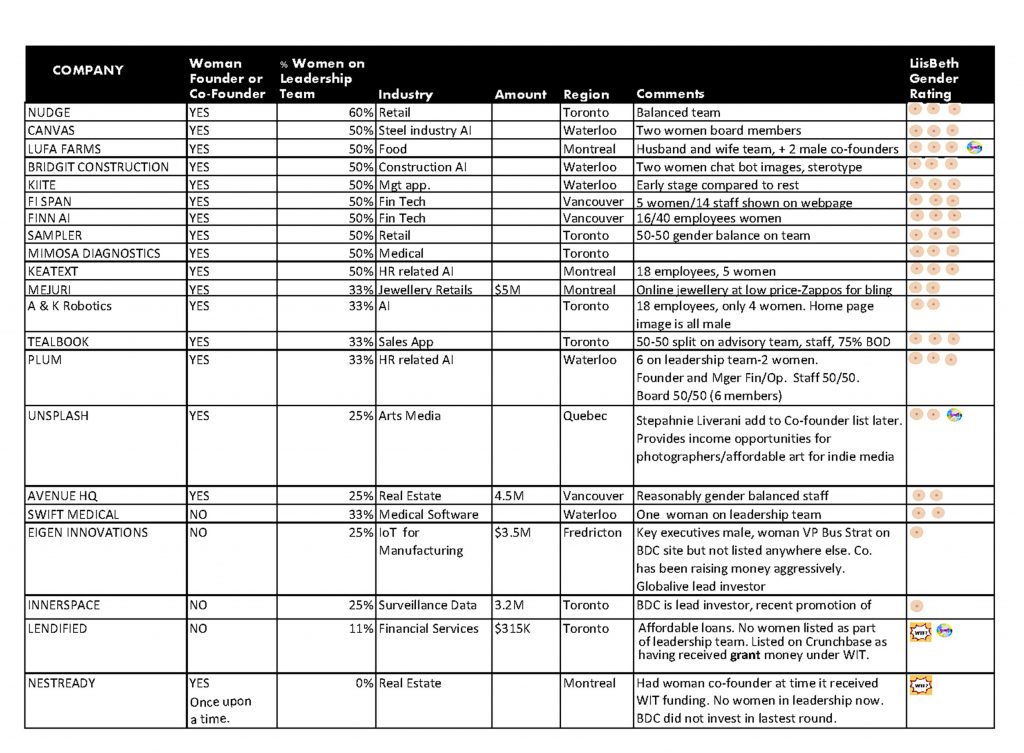

To verify if WIT funds have been invested in ways that at least put more women in tech, LiisBeth reviewed 16 companies listed on the BDC WIT website that received WIT investment this past year plus those recently announced (total of 20). We reviewed company websites, Crunchbase data, other business databases, plus conducted Google searches for media related to the company in the past few years. We looked at the leadership team to see if it included at least one woman. Lendified aside, it turns out that BDC did reward companies that had at least one woman in leadership.

Then we looked for a deeper commitment to gender equity by checking out the gender composition of staff, advisory boards or fiduciary boards, and whether a company’s website art and copy was gender inclusive. We recognize that it’s possible a company’s website or online data is out of date. However, we think that if a team were chasing WIT venture capital, it would ensure their online image was in sync with their pitch.

We summarized our results in the chart below. We awarded three boobs as a “hooray-good job” to companies we felt went beyond the “one woman” benchmark , and two to those we felt just met just this basic criteria. Companies that left us scratching our heads received one boob. Lastly, we gave a plain old “WTF” to those that did not seem to reach even the basic criteria, which is to have at least one woman somewhere on your VIP list on Crunchbase, a PR release, or your “Our Leadership Team” page on your website, even if it is in a traditional female role (i.e., human resources, communications, marketing).

Overall, 16 of the 20 companies had at least one named woman co-founder recognized on their site. Eighteen had a woman in an executive role. That’s the good news. Only three of the companies had all women co-founders, originally. Thirteen of the 20 companies appeared to be committed to gender equity beyond just the leadership team. One company, Nestready had a woman co-founder and woman in a leadership role at one point, but no longer does. BDC says it did not participate in it’s latest funding round as a result.

We awarded three of the companies an “earth” star for creating products that potentially benefit society. The rest are either basically helping you spend money more easily, finding ways to put more tech between you and other humans, or helping companies become more efficient through automation.

To be clear, we’re not opposed to efficiencies or automation. Stronger bottom lines can be a great thing—if that results in companies that pay living wages to gig economy contractors, support local communities, and provide real full-time jobs (in Canada) with benefits for employees, for at least a year or two after implementation. Given this is public money being invested, we would hope BDC pays attention to founder values and intentions post exit.

And one more observation: None of the 20 enterprises that received funding produce products or services that specifically work to advance women and girls in society.

To Wit, What’s Next for WIT?

The WIT fund is the first fund of its kind in the world, according to Michelle Scarborough, the Managing Director, Strategic Investments. She says investments will continue to flow. “We have a very full pipeline.”

Adds Scarborough: “Our due diligence process is in line with best practices in the fund management game. We look for category leaders, whether they have an unfair advantage, own their intellectual property, and have the potential to disrupt and grow fast-globally. Our approach is pretty traditional.”

And that’s where our real concern lies. If Silicon Valley venture dogma and “best practices” entrenched a gender bias in tech in the first place, perpetuating it certainly isn’t going to get us out.

If WIT’s goal is truly to produce gender equality in tech, it must take a different approach, to change the underlying system. Whether it’s getting more women into politics, onto boards, into manufacturing/construction/mining (insert any under represented sector), the strategy of enticing a few women onto the field and expect them to win at a game that is not built for them, even has rules stacked against them, will result in limited, if any real change. Most of them will disengage and start their own business in a sector that is far less hostile to people born with two X chromosomes—versus one. Nestready is an example of a “now you see them, now you don’t” outcome.

What is required for true systems change is a reinvention of the game. If we truly want to see women in tech thrive, we would be better off building a WIT fund built by women, for women, from the ground up.

Jonathan Hera, managing partner at Marigold Capital and expert in gender-lens investing, says BDC’s intention may be good, but sticking to traditional selection criteria is an example of impotence in action. “BDC has the opportunity to re-write the entire rule book when it comes to unleashing the power of women in tech. They could change what success and outcomes look like – long-term economic impact that supports female founders, the products and services they offer, and the underrepresented and marginalized communities they more often serve. To do this would mean altering the basis on which BDC makes decisions, and of course why they do so. Like most of us in the venture space, BDC’s investment processes have deeply embedded implicit and unconscious systems bias, and unless they change the criteria, their success won’t likely meet its intent and opportunity.”

A Solution?

Radicals would say, start over. Segregate the WIT fund entirely. Give it a clean slate. Bring in a group of smart women to redesign the fund from the bottom up. Recruit a kick-ass collective of women in tech to govern the fund. And see where it takes us. For those who think enabling a group of women in tech to manage the fund as a collective is a risky idea, we say two things:

First, our government invests and grants billions of dollars in risky future forward ideas every year to drive economic growth and social change. See #supercluster. $200M is a drop in the bucket.

Second, collectives of men have been running venture capital for years.

At the very least, WIT should strengthen its criteria. It should require evidence of a commitment to gender justice throughout the company — not just at the executive level. Evaluations could require a minimum of 50 percent women on advisory boards, 50 percent women on staff, ideally many in non-traditional roles, as well as a review of marketing materials to assess gender inclusive messaging and evidence of policy that aims to procure at least 10 percent of its supplies and services spend from women-owned firms. It would be wise to add a requirement to complete third-party employee surveys that comment on whether or not the culture is, indeed, inclusive.

Better than all of this, BDC could focus the fund on tech companies that have products and services that advance gender justice in some way—or at the very least develop products that addresses one of the 17 UN Sustainable Development Goals. Given the state of the planet, we could use less investment in extractive and rent seeking “disruption” and more tech companies that focus on reclamation and harmony.

For anyone who moans that there is only one way to measure return on investment, or that stronger criteria slows things down, is too expensive, hard, or intrusive, just tell them to apply to the traditional venture capital funds or one of BDC’s non-women funds that comprise its whopping $33 billion portfolio. Again, the $200 million WIT venture fund is a drop in the bucket. So, let’s make that drop count. Public money investments need to push boundaries and lead the way. That is what governments are uniquely able to do: Think long term and drive needed change when entrenched patriarchal industries and quarterly review–driven mindsets clearly will not.

Surely, we are ready to move beyond, “OMG, they got a woman in the C suite! Tick!”

After all, real change is what most women voted for—and what many will vote for again in the fall.

Editors note: BDC officials say Nest Ready was co-founded by a woman originally and had another woman on the executive team at the time of investment. However, the fact that her existance or contribution to the creation of the enterprise is non existant on any company sits or news releases speaks to what we would call erasure. So we are keeping our rating of “WTF”. It also points out that a firm can evolve back to an all male team after WIT investment. Correction: Lendified received a grant under the WIT fund–not a venture deal.

Related Articles

Read May 2nd OP ED by The Canadian Women’s Chamber of Commerce founder, Nancy Wilson below. “How many women does it take to make a “women-led” company? It turns out you just need one – that is, if you are a tech company looking for investment from a venture fund marketed to support female entrepreneurship and participation in the tech sector.”

Op-Ed: What’s a ‘Women-Led’ Company? We Need a Standard Definition

https://www.liisbeth.com/2018/12/03/feds-drop-9-million-into-womens-entrepreneurship/

https://www.liisbeth.com/2016/06/21/confronting-gender-inequity-inclusion-innovation-space/

You are visiting Liisbeth’s archives!

Peruse this site for a history of profiles and insightful analysis on feminist entrepreneurship.

And, be sure to sign up for rabble.ca’s newsletter where Liisbeth shares the latest news in feminist spaces.

7 replies on “Where are the Women in Canada’s Women in Tech Venture Fund?”

Great article! Just a note that as well as having a female CEO and Founder, Tealbook has 50% female employees, a 50% female advisory board, and a 75% female board of directors. Additionally, our technology is used to help women-owned businesses connect and work with large corporate partners. We are big champions of women in tech!

Yes! We noticed! updated! You got the 3-boob sticker rating! Congratulations! Maybe a profile on Tealbook soon!

In addition to having a woman CEO and cofounder, Plum has 50% women employees and 50% women on our board of directors. We are incredibly committed to diversity and inclusion, which is reflected in our diverse staff. Also, our technology is used to help companies increase their diversity and inclusion: https://www.plum.io/diversity

Yes, we noticed. Congrats!

I think that the problem is partially a lack of policy research – and a lack of market research. There were 3000 women founders who applied to 200 spots in the $20 M WEF program. And there is a $200 M WIT Fund that can’t find enough women founders to make the investments that it wants to make.

Increasing the representation of women in the tech sector is a multifaceted issue and there are no easy fixes.

If we want more women role models in the tech sector, then the criteria for funding needs to focus on women in technical roles. If we want to attract and retain women as employees in the tech companies, then we need the criteria to focus on gender diversity metrics (including retention) of tech roles within companies looking for investment. If we want to encourage and support women tech entrepreneurs, then the investment criteria must simply be women tech entrepreneurs.

I think the WIT Fund is a positive step and congratulate the BDC in trying to make a difference. However, I personally disagree with the criteria used to evaluate potential investments.

You can read more about my thoughts on standard criteria for the terms ‘women-led’ in an op-ed published today in the Globe & Mail here: https://www.theglobeandmail.com/business/commentary/article-whats-a-women-led-company-we-need-a-standard-definition/

If you’re not a G&M subscriber, the text of my op-ed is posted on the Canadian Women’s Chamber of Commerce website here: https://canwcc.ca/women-led-company-standard-definition-criteria/

I’m interested in feedback and dialogue around the criteria I propose in the article.

There are other issues as well, including the 1M sales requirement. Early stage support is not available to create the pipeline for women led companies to scale.